Lessons I Learned From Info About How To Become A Private Investor

Have a net worth of at least $1 million alone or.

How to become a private investor. Perhaps the easiest way is to find a local company that can use some extra capital and buy in as a partner. More in startups, different industries etc)? An accredited investor is a person or entity that is allowed to invest in securities that are not registered with the sec.

Remember that this financial help comes from sources that focus on investment, such as an angel investor or venture capital firm. How to get into private equity: Do i need to be an accredited investor and have a better background?

February 8, 2023 / in financing, manage your money / by brandon wyson. There are many types of private investors — for example, both your cousin and a multimillionaire venture capitalist could fall under the private. Investors should plan to hold their private equity investment for at least.

The seven habits of highly successful private investors. I’ll be upfront with you: The minimum investment in private equity funds is typically $25 million, although it sometimes can be as low as $250,000.

How would i start being a private investor (starting small of course. To be an accredited investor, you must meet certain income and net worth criteria, such as having a net worth of at least $1 million or an income of at least $200,000 in each of the past two years. Private investors can share in your profits, unlike traditional business loans, which require repayment, creating a potentially mutually beneficial arrangement.

Individual accredited investor requirements (financial) accredited investors must meet one of the following requirements: The short answer:a private investor is a person or company that invests their own money into a company, with the goal of helping that company. Register to attend a free online real estate class and learn how to get started investing in real estate.

Table of contents. Find out how to invest in private equity here. Private investors are individuals and organizations that invest their own money into a business.

How to become an investor in 5 steps. It profiles a dozen successful private investors, with insights into their lifestyles as well as their methods. There are several avenues to consider when you’re getting started in private equity investing.

Fragile places range from areas affected by conflict to those at risk from climate events or experiencing bad harvest years. A private investor can be an individual or a company. Learn about interviews, resumes, the recruiting process, and how you can succeed.

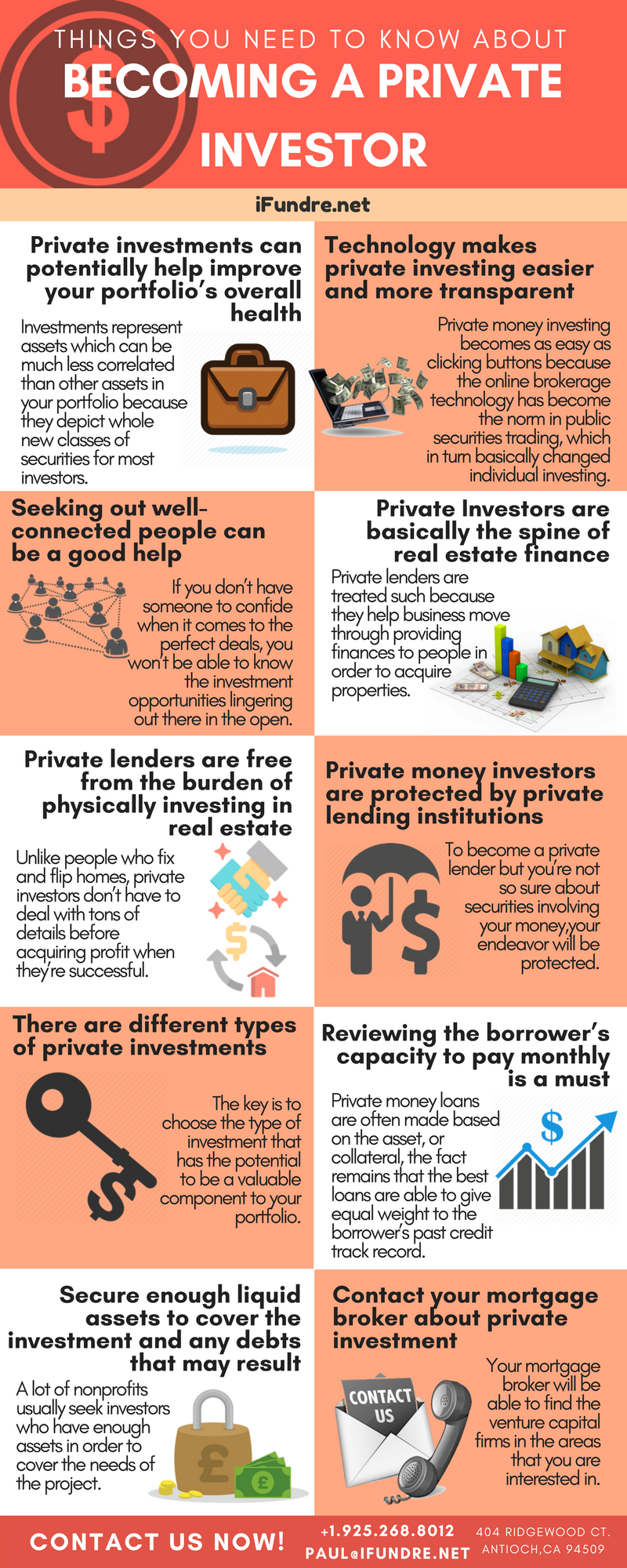

Getting into private equity isn’t easy. Private investors are the individuals or firm that shows a keen interest in investing their money in a company to lend a financial hand to the company & contribute to its growth & earning a value for their investments. Private equity is an umbrella term that covers different types of private investments, funds, and firms.