Breathtaking Info About How To Obtain Itin

How to find an itin number.

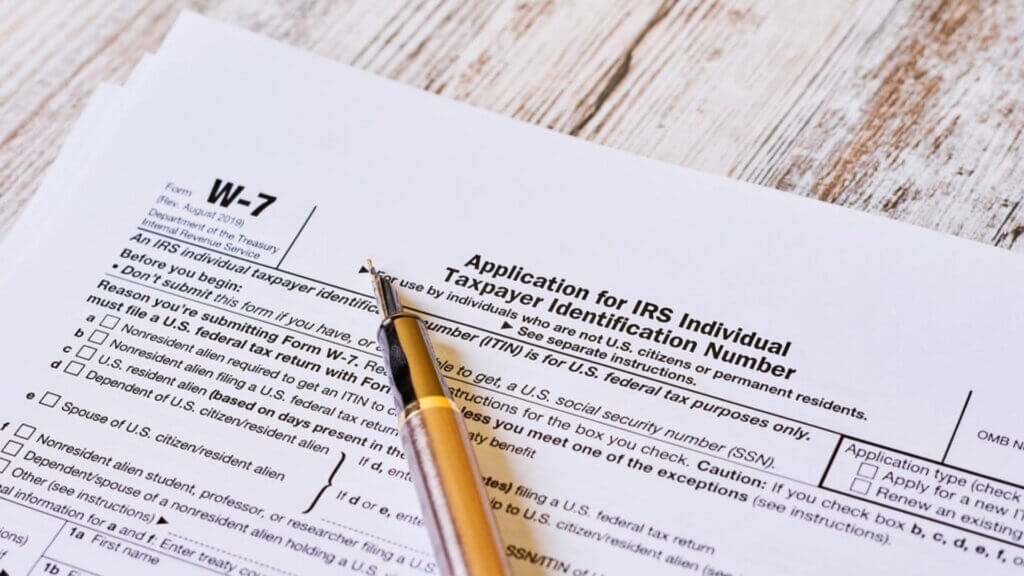

How to obtain itin. The individual taxpayer identification number. How do i obtain an individual tax identification number (itin)? How can i obtain an itin from abroad?

You can apply for an itin any time during the year when you have a filing or reporting requirement. Updated on january 7, 2024. Step 1 :

Receiving tax return from the irs. There are 13 acceptable documents. You are eligible to apply for an itin if:

How to dispute errors on your credit report. As irs certifying acceptance agents, we’re trained and authorized by the irs to. There are 3 ways to apply for an itin:

Find out if you qualify for an individual taxpayer identification number and download the form to obtain your itin. Obtain an individual taxpayer identification number (itin) teaching, interpreting, & changing law since 1979. Alien taxpayers who need an individual taxpayer identification number (itin) may be able to secure one from outside.

Also, you must supply a federal income tax return. You must prove your foreign/alien status and identity. The irs issues itins to individuals who are required to.

Getting an itin. Irs streamlined the number of documents the agency accepts as proof of identity and foreign status to obtain an itin. Filing or reporting requirement under the internal revenue code.

If you are residing outside the usa and want to start a business here then there are several. You need this number if. How to obtain an itin.

How to get an itin: There are 3 ways you can apply for an itin number: An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service.

Steps to get a credit report with an itin.