Formidable Tips About How To Get A Better Credit Score

There are four main ways to get your credit score:

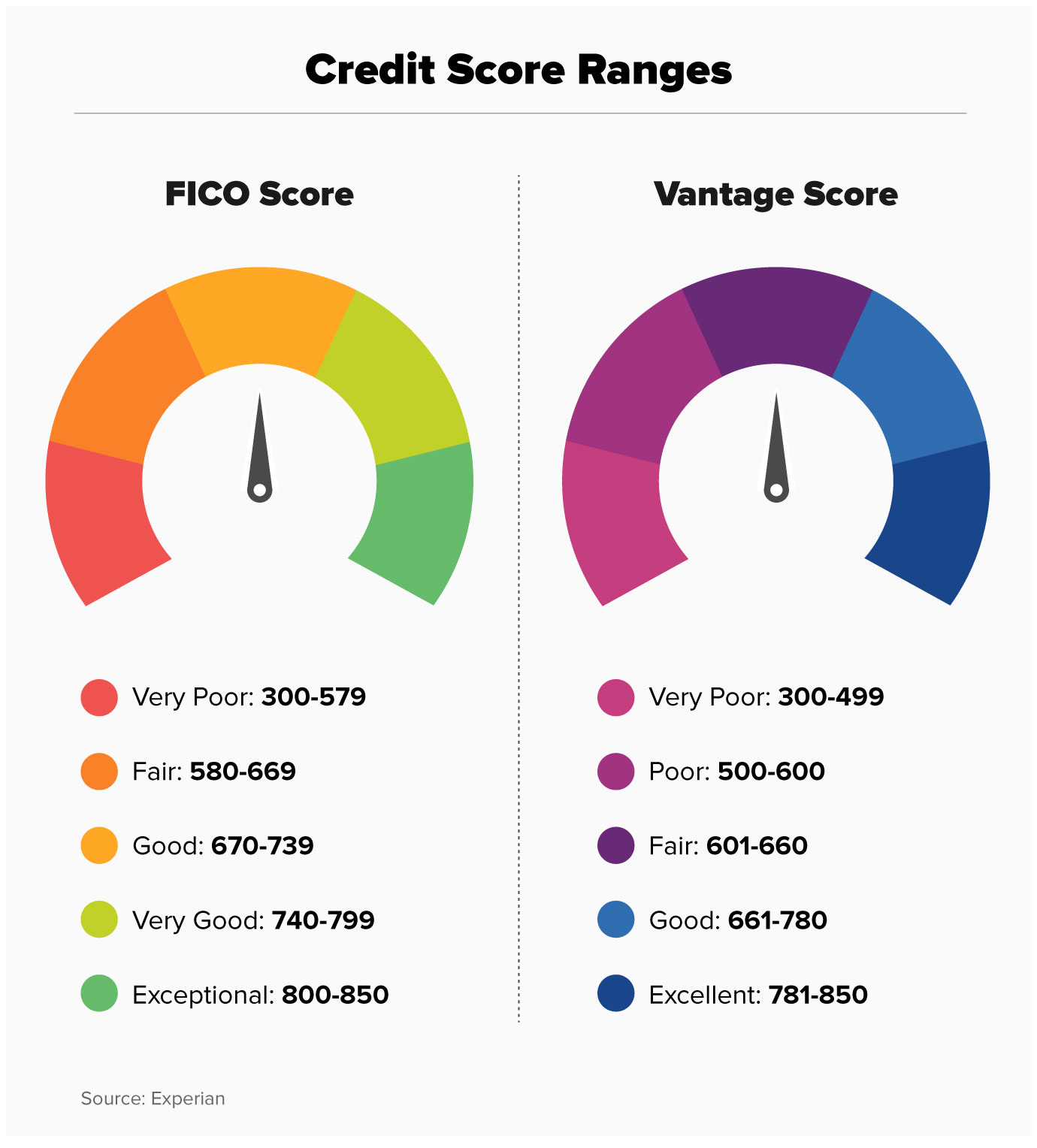

How to get a better credit score. With the monthly payment in mind, confirm whether you can. There are two credit bureaus in canada, equifax and transunion, that can tell you your credit score. Fico and vantagescore, which are.

Fortune recommends credit cards expert tips for building and improving your credit score a good credit score matters. Martin lewis updated 13 february 2024 everyone should take time to manage their credit report and score. Improve your credit score.

The purpose of a secured card is to build your credit enough to qualify for an unsecured card — a card without a deposit and with better benefits. Your credit score plays a crucial role in determining the mortgage loan interest rate you'll be offered. Here's how to build credit fast:

Talk to a credit or housing counselor. By erin bendig last updated 27 september 2022 is your credit score low? 1) payment history of credit cards and loans.

Additionally, equifax scores are accessible through borrowell. Check your credit or loan statements. Paying your bills on time is the most important thing you can do to help raise your score.

Here are five tips for improving your score. Unlike a lot of financial metrics, your credit score. Multiply the result by 100 to see this as a percentage.

Make your payments on time. Build payment history cs max build supersized credit how quickly does your credit score update? Keeping your credit utilization ratio low —around 30% or lower — will improve your credit score.

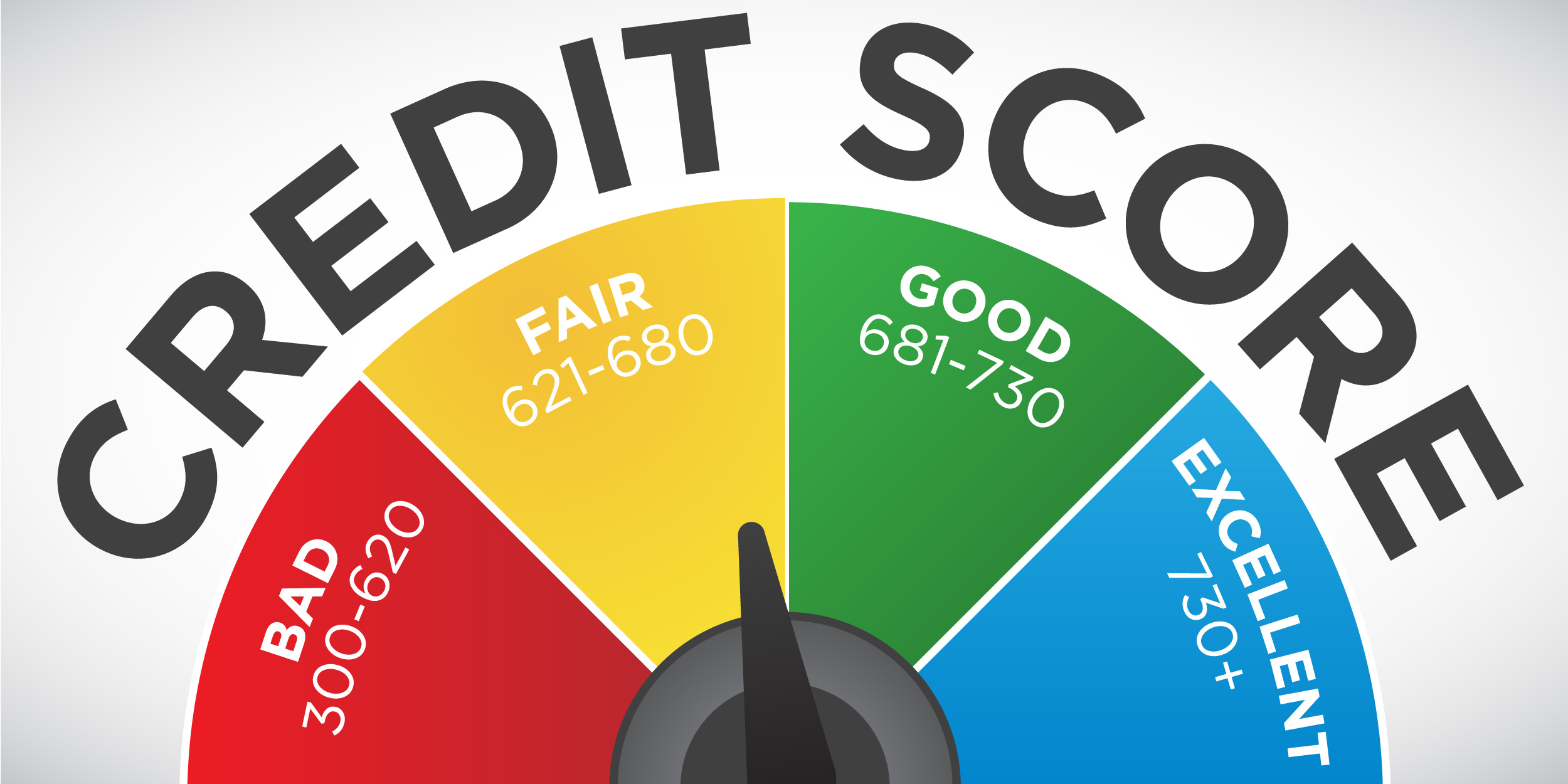

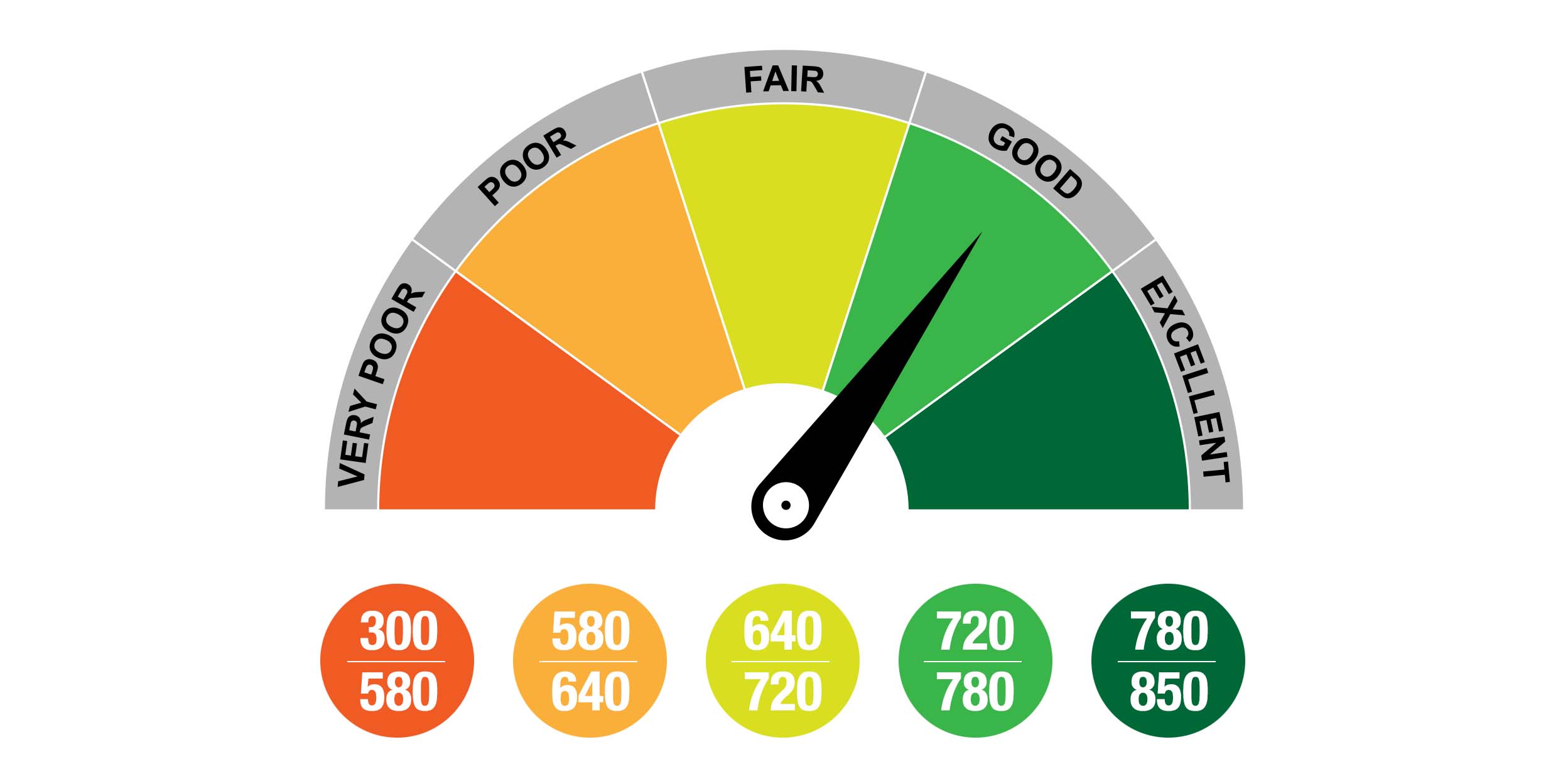

Try following the steps below. Here are the five primary factors that determine your fico score, from most to least important: For those with poor credit — reflected by a score of 619 or lower — large banks charged a median rate of more than 28 percent, compared with about 21 percent.

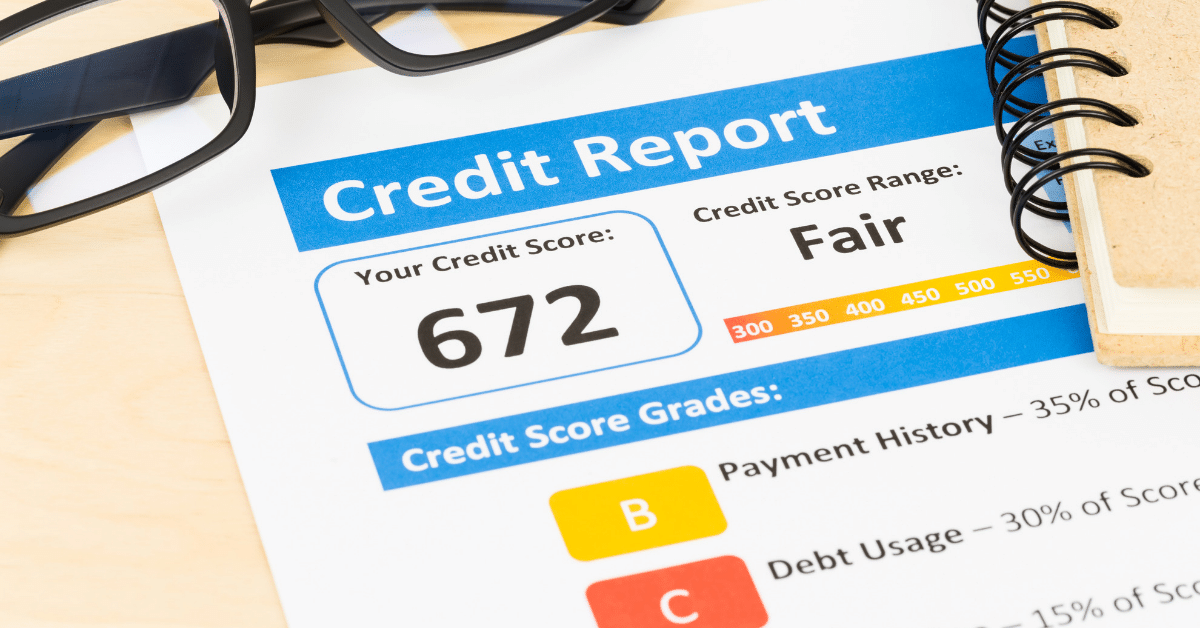

Here are the ranges experian defines as poor, fair, good, very good and exceptional. The two most prominent credit scores are. Of the three credit bureaus, experian offers the best user experience.

Check your credit score and credit report your credit report contains information about how you’ve used credit in the past 10 years. Find a credit score service. Calculate what your monthly payment would look like for each loan (if it wasn’t already provided).

![7 Tips to Increase Your Credit Score [Infographic]](http://www.trimurty.com/blog/wp-content/uploads/2016/12/Infographic-7-01-1.jpg)